Stepping into retirement as a single woman carries a sense of exhilaration and a hint of the unknown. We understand how it feels to face this journey on your own, and we’ve found that cultivating a garden is just one of 120 invigorating ideas to add color to these golden years.

Our guide brims with actionable tips designed to stabilize your finances, ignite an engaging social life, and sustain your health — all while honoring the distinctive path trod by what to do in retirement as a single woman.

Let’s embrace this season together, transforming it into an immensely fulfilling expedition!

Key Takeaways

- Make a plan for your money that matches your dreams for retirement, and think about ways to earn extra income.

- Choose where you live based on what is nearby, like family and hospitals, and if it fits your budget.

- Save money for surprises so you don’t worry about sudden costs.

- Keep meeting new people through clubs or groups to avoid feeling lonely.

- Stay healthy by being active and eating good food. Consider buying insurance that pays for care when you’re older.

Table of Contents

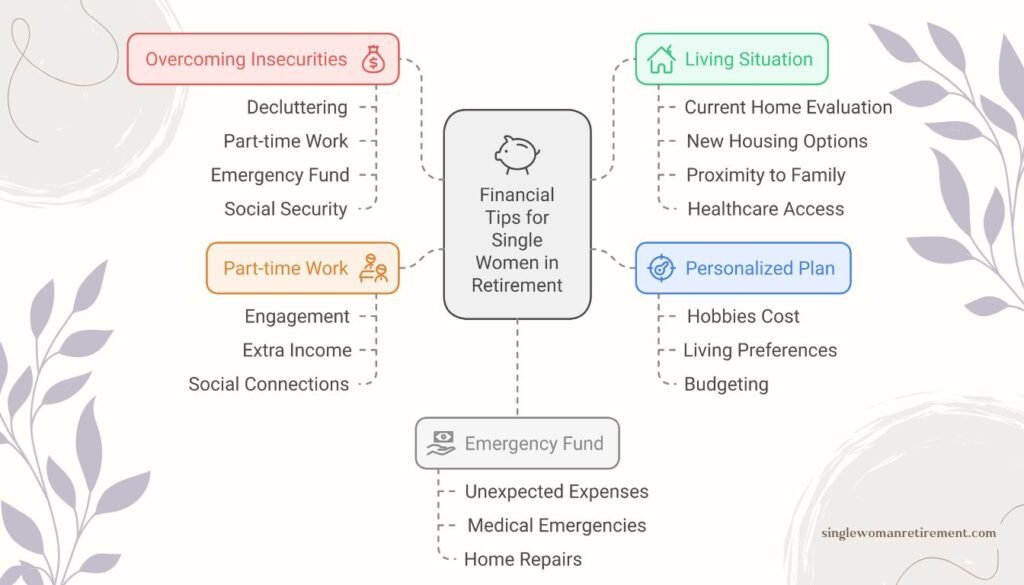

Financial Tips for Single Women in Retirement

Create a personalized financial plan that considers your individual needs and goals. Overcome any financial insecurities by exploring different options for income and budgeting.

Create a personalized plan

We know every single woman has her dreams for retirement. That’s why we make a plan that fits you. You look at how much money you need, what hobbies cost, and where you want to live.

We remember that general rules might not fit your life as a single person.

Consider your wishes and needs to build your unique retirement plan. We count our money, decide on fun things we want to do, like travel or classes, and then see how it all fits together.

Our plan helps us stay happy without spending too much.

Overcome financial insecurities

Creating a personalized retirement plan is crucial, especially for a single woman. Start by decluttering and making space for new adventures. Consider your living situation and explore part-time work options to boost your income.

Building an emergency fund and assessing Social Security options will provide financial security. Remember, saving before retiring and spending wisely afterward are key to enjoying retirement without money worries.

Maintaining a schedule can also help overcome financial insecurities in retirement. Staying active and engaged makes it possible to keep both boredom and unnecessary spending at bay.

Assess your living situation

When it’s time to retire as a single woman, assessing your living situation is crucial. Consider the practicality and affordability of your current home or explore other housing options that better suit this new phase in life.

Evaluate factors such as proximity to family and friends, access to healthcare services, and community resources. Making intelligent decisions about where you live can significantly impact your retirement experience.

Choosing the right location for retirement provides a sense of security and comfort while allowing for opportunities to engage in social activities, pursue hobbies, and maintain an active lifestyle.

Consider part-time work

Are you thinking about part-time work as a single woman in retirement? It can be a great way to stay engaged, earn extra income, and continue utilizing your skills and experience. Part-time work can also provide social connections and a sense of purpose, contributing to your emotional well-being during retirement.

Moreover, it can help you build up additional savings for unexpected expenses or indulge in activities that bring you joy without burdening your finances.

Exploring part-time work options after retirement is an opportunity to keep yourself mentally active and engaged while enjoying the flexibility of this phase of life. Whether pursuing a passion project or taking on a role that aligns with your interests, part-time work can add fulfillment to your retired life while supplementing your financial security.

Build an emergency fund

Saving money for unexpected expenses is crucial, especially during retirement. We should prioritize building an emergency fund to cover unforeseen medical emergencies or home repairs.

By setting aside a portion of our income regularly, we can create a safety net that provides peace of mind and financial security in times of need. Remember, having an emergency fund allows us to handle unexpected situations without dipping into our retirement savings or accumulating debt.

Ensuring an emergency fund before retiring is essential for maintaining financial stability and independence. Sticking to a budget and consistently contributing towards this fund is essential, as it is a buffer against any unforeseen financial challenges that may arise during retirement.

Explore Social Security options

Retiring single as a woman opens options for Social Security benefits. Consider these points:

- Understand your benefit options based on your work history or your spouse’s.

- Review the implications of claiming early versus waiting until full retirement age.

- Learn about survivor benefits if you’re widowed or divorced after a long marriage.

- Explore how working in retirement may affect your Social Security benefits.

- Consider potential tax implications of Social Security income.

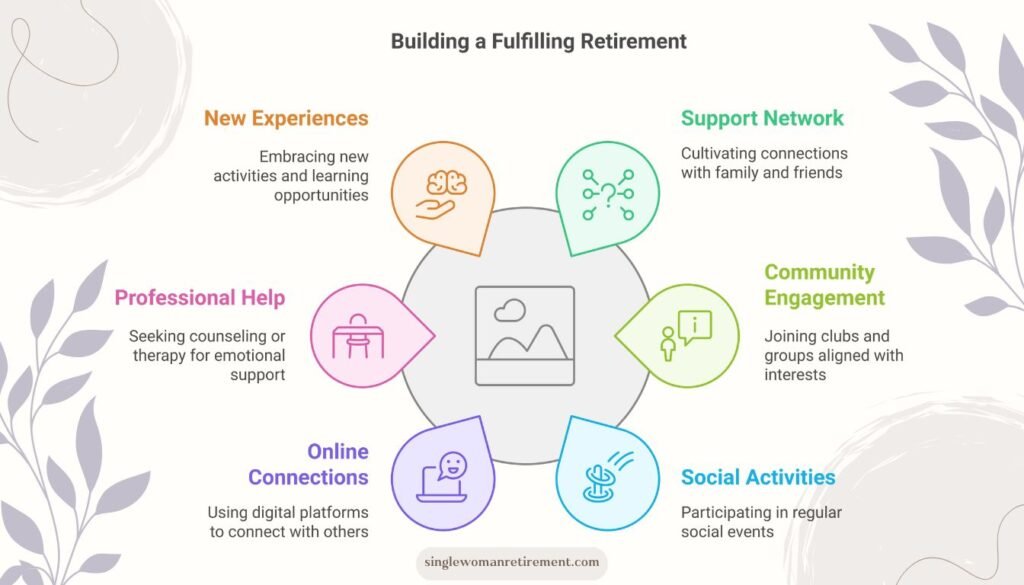

Emotional and Social Tips in Retirement

Cultivate a support network of friends and family who understand and validate your experiences. Stay social by joining clubs, groups or organizations that align with your interests and hobbies.

Avoid emotional loneliness by actively seeking out new connections in your community.

Cultivate a support network

To ensure a fulfilling retirement, it is essential to cultivate a strong support network. Here are some tips to help you build and maintain meaningful connections:

- Stay connected with family and friends to create a sense of belonging and emotional support.

- Join community groups or clubs that align with your interests, providing opportunities to meet like-minded individuals.

- Engage in regular social activities such as volunteering, attending cultural events, or participating in group fitness classes to expand your social circle.

- Consider seeking out professional counseling or therapy if you are feeling isolated or emotionally overwhelmed.

- Explore online forums and social media platforms tailored to retirees, offering virtual connections with others in similar life stages.

- Build relationships with neighbors and local acquaintances by organizing casual gatherings or initiating conversations during daily activities.

Stay Social

Cultivating a solid support network is essential as we retire. Making new friends and connections can bring fresh energy and perspectives, keeping us engaged and fulfilled.

Social activities like game nights, group exercises, or volunteering can be great ways to connect with others while enjoying meaningful experiences together.

Finding local clubs or community groups based on shared interests, such as gardening, book clubs, or dance classes, can provide opportunities to meet like-minded individuals. Staying connected with family and friends through regular visits or virtual gatherings helps maintain relationships that contribute positively to our emotional well-being.

Avoid emotional loneliness

To avoid emotional loneliness in retirement, it’s essential to cultivate a strong support network and engage in social activities. Connecting with family and friends can help combat feelings of isolation.

Embracing new experiences and self-discovery while staying socially active is crucial for finding purpose during this phase of life. Engaging in hobbies, volunteering, or joining community groups can also provide opportunities for meaningful connections.

Additionally, considering part-time work or mentoring roles can offer avenues for social interaction while contributing to the community.

It’s essential to prioritize heart health and stay physically and mentally active to maintain overall well-being and reduce the risk of emotional loneliness. By creating a routine that includes regular exercise and engaging activities, single women in retirement can promote positive mental health while also building a sense of structure and purpose in their daily lives.

Make new friends and connections

Making new friends and connections in retirement is essential for a fulfilling life as a single woman. Here are some tips:

- Join community groups or clubs related to your interests, such as book clubs, gardening groups, or volunteer organizations.

- Attend local events and gatherings to meet new people and form meaningful connections.

- Use social media and online platforms to connect with like-minded individuals in your area.

- Take classes or workshops to learn new skills and interact with fellow participants.

- Reach out to old acquaintances or colleagues to rekindle friendships and expand your social circle.

- Host small get-togethers or dinner parties to bring people together in a comfortable setting.

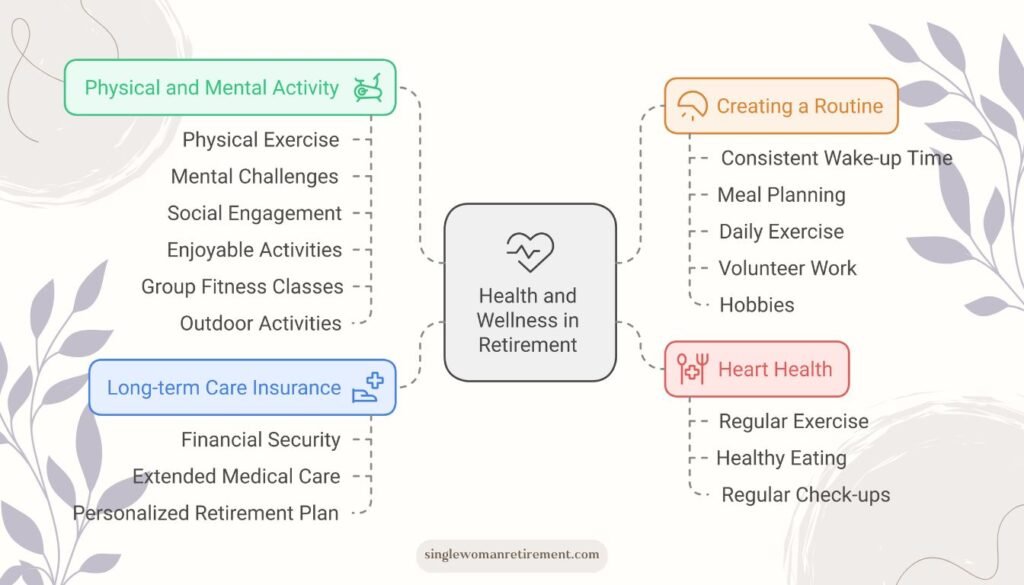

Health and Wellness Tips in Retirement

Prioritize your heart health by staying active, eating a balanced diet, and scheduling regular check-ups. Consider long-term care insurance to ensure you are prepared for future health needs.

Stay physically and mentally active to maintain overall wellness in retirement.

Prioritize heart health

Maintaining a healthy heart is crucial in retirement. We should stay physically active by exercising regularly to keep our hearts strong and reduce the risk of cardiovascular diseases.

Additionally, we can make heart-healthy food choices by including plenty of fruits, vegetables, whole grains, and lean proteins in our diet. It’s essential to go for regular check-ups with healthcare professionals who can monitor our heart health and provide guidance on maintaining a healthy lifestyle.

We can enjoy an active and fulfilling retirement without health issues by prioritizing heart health. Taking proactive steps today can contribute to a happier and healthier tomorrow.

Consider long-term care insurance

When considering retirement as a single woman, it’s crucial to consider long-term care insurance. This type of insurance can play a vital role in ensuring financial security and peace of mind for the future.

Planning for potential health needs is essential to retirement, especially for those living alone.

Long-term care insurance helps cover the costs associated with extended medical or custodial care that may not be fully covered by traditional health insurance or Medicare. It’s essential to assess this option early on and include it in your personalized retirement plan.

Stay physically and mentally active

Staying active is essential for a fulfilling retirement. Here’s how to do it:

- Regular physical exercise, such as walking, swimming, or yoga. This can help maintain your overall health and well-being.

- Challenge your mind by learning new things, such as taking up a new hobby, learning a musical instrument, or studying a new language.

- Stay socially engaged by joining clubs, volunteering, or participating in community events. This can help keep you mentally sharp and emotionally fulfilled.

- Keep yourself busy with activities you enjoy, such as gardening, painting, writing, or cooking. These can provide a sense of purpose and accomplishment.

- Schedule regular outings with friends and family to stay connected and keep your social life active.

- Consider joining group fitness classes or sports teams to stay physically fit while meeting new people and making friends.

- Get involved in mental challenges like puzzles, Sudoku, or brain games to keep your mind active and engaged.

- Explore outdoor activities like hiking, biking, or birdwatching to stay physically active while enjoying nature.

Create a routine

We know that retirement can bring many changes in your daily life. Creating a routine is essential to maintain structure and purpose in your days. Start by setting a consistent wake-up time, planning meals, and incorporating exercise into your day.

This can help you stay active, healthy, and engaged with the world around you. Having a routine in place can also provide a sense of stability and control as you navigate this new phase of your life.

Regular activities like volunteer work or hobbies can give meaning to your days and keep you connected to the community. It’s essential for maintaining mental sharpness while providing opportunities for social interactions.

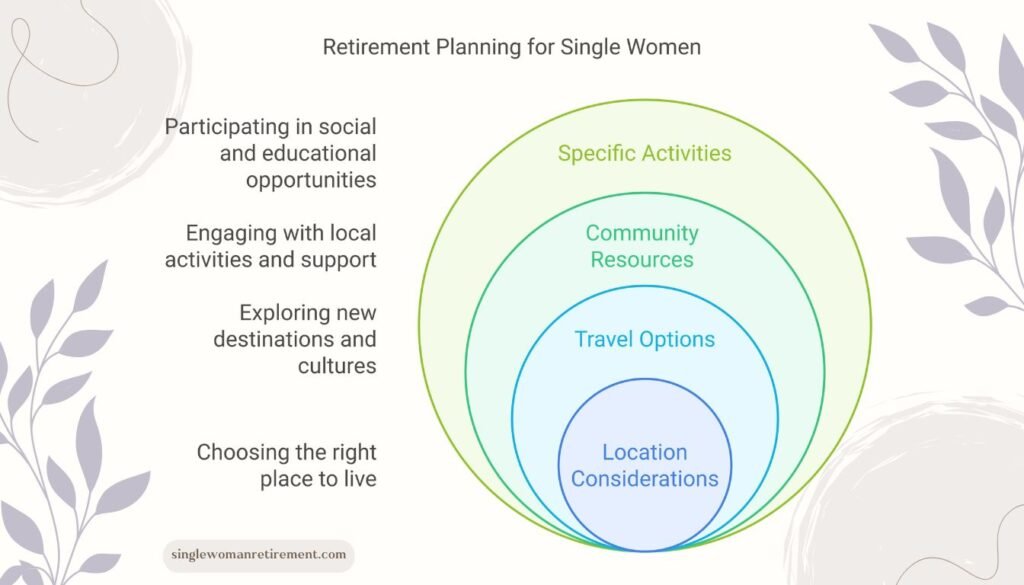

Location Considerations in Retirement

Think carefully about where to live, consider travel options, and evaluate community resources to make the most of retirement as a single woman. Read more for valuable insights on making the most of your retirement years!

Think carefully about where to live

When choosing where to live, consider factors like proximity to family and friends, access to healthcare, and the overall cost of living. Research potential locations for retirement that offer the amenities and activities you enjoy.

Look into community resources, social opportunities, and support networks available in each location.

Evaluate travel options from your potential new home base, ensuring easy access to places you want to visit or explore. Lastly, assess the community’s safety and how well it aligns with your lifestyle preferences as a single woman in retirement.

Consider travel options

When planning for retirement as a single woman, considering travel options can add excitement and adventure to your golden years. Exploring new destinations and cultures can be enriching and fulfilling. Here are some travel tips to consider:

- Research and plan trips that align with your interests and budget, whether solo travel, group tours, or visiting family and friends.

- Consider senior discounts and special retirement packages when booking flights, accommodations, and activities.

- Consider joining travel clubs or groups catered to older adults to enjoy companionship during your trips.

- Explore travel experiences such as cruises, road trips, international adventures, or relaxing beach getaways.

- Prioritize health and safety by ensuring insurance coverage for medical emergencies while traveling.

Evaluate community resources

In retirement, evaluating community resources is essential to maximize your time. Here are some ways to do that:

- Research local senior centers and clubs to find social activities and support networks.

- Explore volunteer opportunities with organizations that align with your interests and skills.

- Investigate community education programs or classes for continued learning and engagement.

- Look into local fitness or wellness programs tailored for retirees, such as yoga or walking groups.

- Connect with faith-based communities for spiritual enrichment and social connections.

- Seek out libraries and book clubs for intellectual stimulation and community.

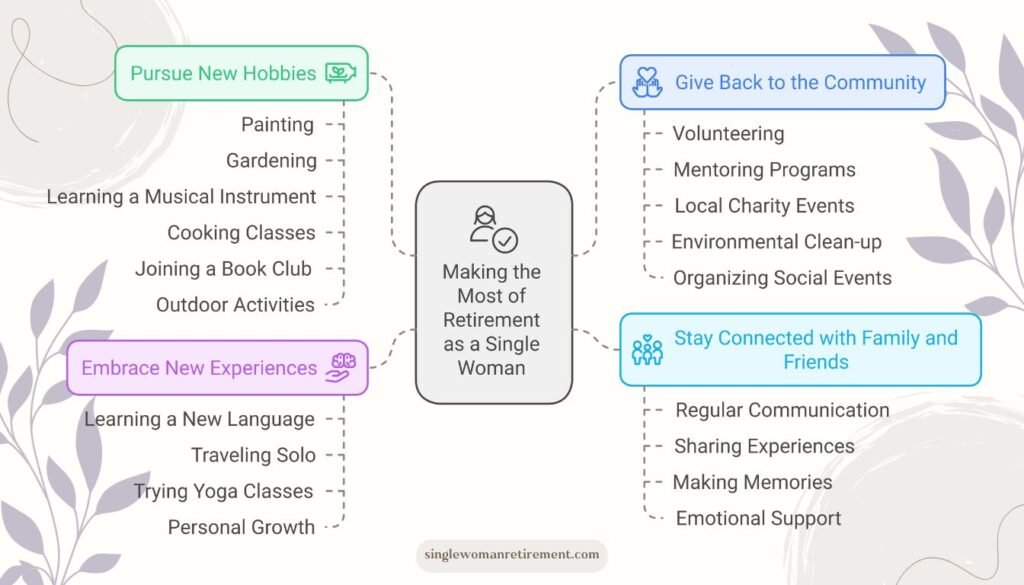

Making the Most of Retirement as a Single Woman

Pursue new hobbies and interests, give back to the community, stay connected with family and friends, and embrace new experiences and self-discovery. These tips will help single women in retirement make the most out of their golden years.

Pursue new hobbies and interests

Retiring as a single woman allows us to explore new hobbies and interests. Here are some fresh ideas to consider:

- Discover the joy of painting, whether it’s with watercolors, acrylics, or oils.

- Try gardening to connect with nature and enjoy the fruits of your labor.

- Learn a musical instrument or revisit one you used to play for personal enjoyment.

- Explore different cuisines through cooking classes and expand your culinary skills.

- Dive into the world of literature by joining a book club or starting one with friends.

- Embrace outdoor activities like hiking, birdwatching, or photography for a healthy lifestyle.

Give back to the community

When we give back to the community, we enrich our lives and those around us. Volunteering can bring a sense of purpose and fulfillment in retirement. Take the time to explore different opportunities, such as mentoring programs or local charity events.

It’s not only beneficial for the community, but it also helps maintain social connections and keeps you active.

Engaging with community projects or initiatives enables single women in retirement to share their skills and experiences while positively impacting others’ lives. Whether participating in environmental clean-up efforts or organizing social events for seniors, giving back fosters a sense of belonging and satisfaction.

Stay connected with family and friends

We encourage you to stay connected with family and friends during retirement. Regular communication can help maintain strong relationships, providing emotional support and companionship.

Sharing experiences and making memories with loved ones can bring joy and fulfillment in this phase of life, enhancing your overall well-being. Embracing new experiences together enables you to create lasting bonds and discover a sense of purpose in this chapter.

By staying connected, single women retirees can access valuable emotional support from their loved ones. Engaging in meaningful conversations and activities with family and friends fosters a sense of belonging, contributing to a fulfilling retirement lifestyle enriched by social connections.

Embrace new experiences and self-discovery.

In retirement, we can embrace new experiences and self-discovery. It’s an opportunity to explore interests we’ve always been curious about, like learning a new language, painting, or volunteering for a cause close to our hearts.

Exploring these new experiences can lead to self-discovery and personal growth. Whether traveling solo, joining a book club, or trying yoga classes for the first time, embracing new experiences can bring joy and fulfillment in this next chapter of life.

Retirement as a single woman offers the chance to pursue passions that may have taken a backseat during our working years. Finding purpose and fulfillment through new experiences can be empowering and enriching.

Conclusion: What to Do in Retirement as a Single Woman

In conclusion, retiring as a single woman can be a rewarding phase of life. You can make the most of this new chapter by creating a personalized financial plan and prioritizing your emotional well-being.

From staying socially active to exploring new hobbies, countless opportunities exist to live your best retirement life. With careful planning and an open mindset, you can embrace this period with enthusiasm and fulfillment.

Read More about Retirement Plans

- The Best Country for a Single Woman to Retire: A Comprehensive Guide to Safe and English-Speaking Destinations

- The Best Places Abroad to Retire for a Single Woman: A Comprehensive Guide

- Where Should a Single Woman Retire? Top 25 Best Places for Single Retired Females

- Where to Retire as a Single Woman: Top 10 Destinations for Single Retired Females

- Expert Retirement Advice for Single Women: Planning for a Secure Future

FAQs

1. How should a single woman plan for retirement?

A single woman can plan for retirement by saving money carefully, understanding health insurance options, and setting up legal directives to secure her future.

2. What are some social activities for single women in retirement?

Single retirees can join clubs or groups that interest them. They might also enjoy classes or trips with others who like the same things.

3. Can a single retired woman get social security?

Yes, single retirees can get social security money based on their work history or spouse’s record if they were married before.

4. Why is long-term care important for single women retiring?

Long-term care plans help make sure that as you get older and may need more help, you have ways to pay for this care and keep living comfortably.

5. Where are good places for a single woman to retire?

The best places to retire are areas with community resources, support networks, fun activities, and good healthcare nearby.