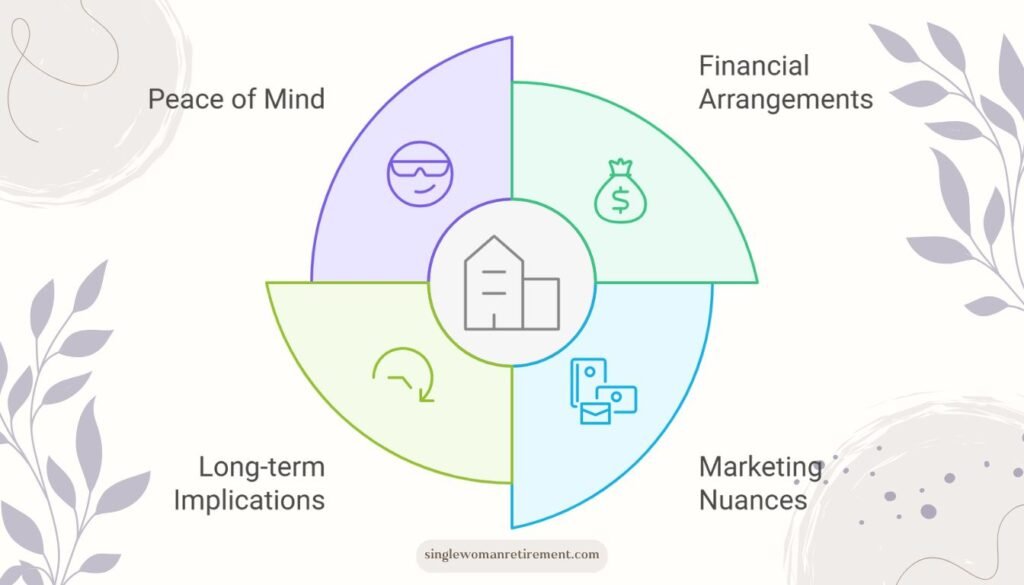

Selecting the perfect retirement community for yourself or a family member can often feel like trying to solve a puzzle with missing pieces. Each brochure radiates with promises of relaxation and blissful living, yet deciphering the subtle nuances between the lines requires more than a casual glance.

It’s a shared experience—thumbing through vibrant pamphlets only to sense that they may not tell the whole story.

We empathize with this because those paths are familiar to us, too. Our team has delved into all corners of senior living to discover the realities that don’t always make it into marketing materials—such as specific communities having preferences for private pay arrangements over Medicaid, potentially affecting long-term finances in ways you might not expect.

This article pulls back the veil, exposing 10 things retirement communities won’t tell you, which are crucially important for you to understand before making this significant move.

Brace yourself: our frank discussion could provide valuable clarity and direction, ensuring your peace of mind about what lies ahead. Continue reading; there’s much here that may enlighten you!

Key Takeaways

- Retirement communities may not fully disclose all potential charges, so it’s crucial to inquire about hidden costs, such as additional expenses for specific services or amenities.

- Understanding the differences between various types of retirement communities is essential to make an informed decision that aligns with individual needs and preferences.

- When considering a retirement community, it’s essential to carefully evaluate the availability of on-site medical care, proximity to hospitals, and access to necessary health services.

- Potential financial responsibility for parents’ bills and the preference for private payment over Medicaid are significant factors to consider before committing to a retirement community.

Table of Contents

Getting to Know Retirement Communities

Retirement communities can vary widely regarding services and amenities, from independent living to assisted care. Understanding the differences and what each community provides is essential before deciding.

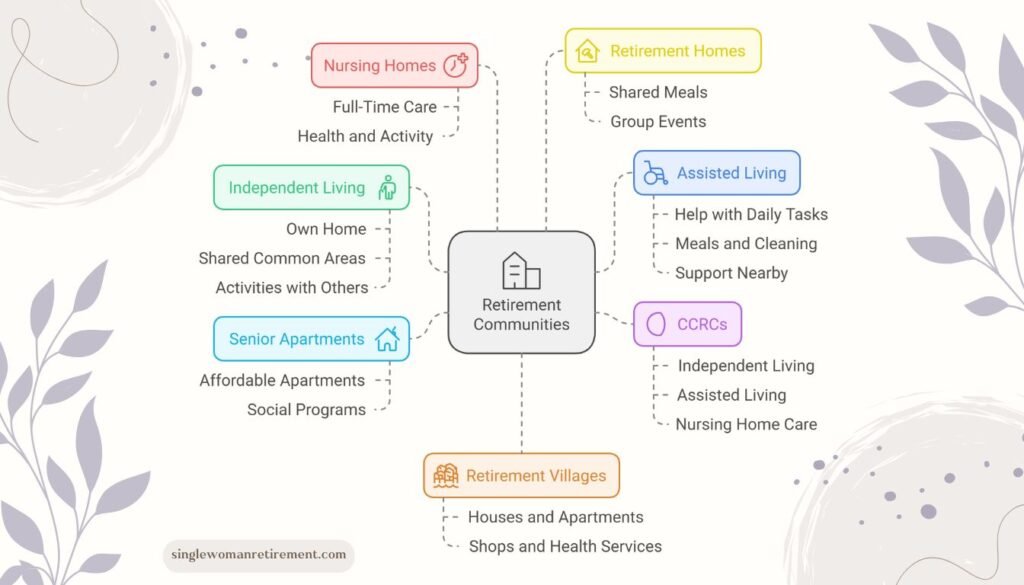

Different types of retirement communities

We know choosing the right place for retirement is a big deal. There are many kinds of communities, each offering different services and lifestyles.

- These places are for people who are 55 and older.

- In these communities, you can live in your own home but share common areas and enjoy activities with others.

- Here, seniors can live independently and get help with daily tasks like meals and cleaning.

- This option is great if you still want to do many things alone, like having support nearby.

- Assisted living gives more help with daily life, like bathing, dressing, and taking medicine.

- People needing regular help but not full-time nursing care often choose this type.

- CCRCs provide a mix of independent living, assisted living, and nursing home care all in one place.

- This means you can stay in the same community even if your health needs change over time.

- These buildings or complexes offer apartments just for older adults.

- They usually cost less and might have social programs to join in on.

- These places give full-time care to seniors who can’t live alone safely anymore.

- Nurses and other staff members ensure residents stay healthy and active as much as possible.

- Retirement homes offer a spot for older adults who can mostly care for themselves.

- They might have some shared meals or group events, too.

- A retirement village is like a small town just for seniors.

- You’ll find houses, apartments, shops, and health services together here.

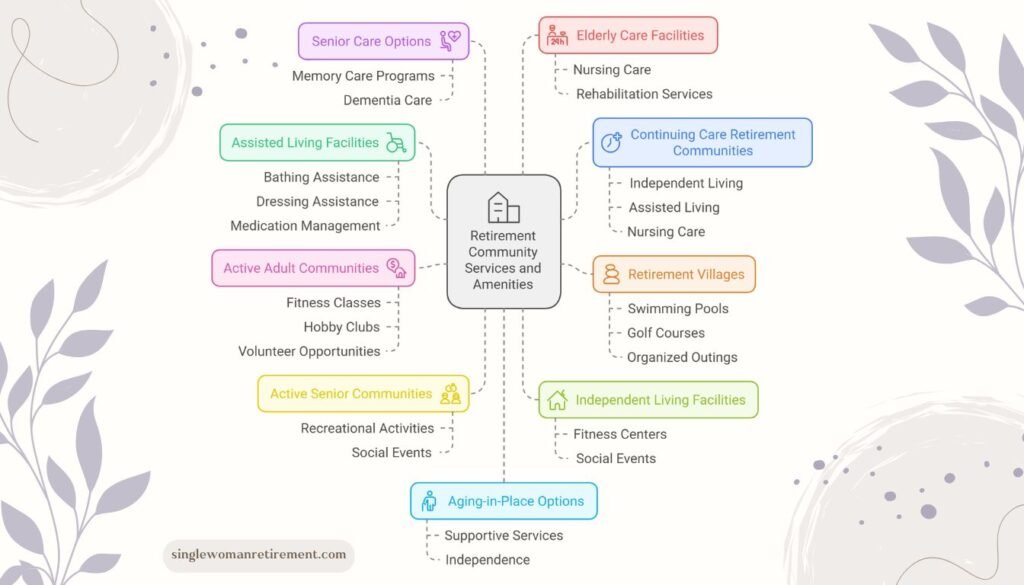

Common services and amenities

Retirement communities offer various services and amenities to cater to the needs of their residents. It’s essential to understand what these communities provide before making a decision. Here are some standard services and amenities offered by retirement communities:

- Assisted living facilities help with daily activities like bathing, dressing, and medication management.

- Continuing care retirement communities offer a continuum of care, including independent living, assisted living, and nursing care, as needs change.

- Active senior communities focus on social engagement and recreational activities tailored to the interests of older adults.

- Independent living facilities provide maintenance-free living arrangements and access to fitness centers and social events.

- Senior care options can include specialized memory care programs for individuals living with dementia or Alzheimer’s disease.

- Elderly care facilities may offer 24-hour supervision, nursing care, and rehabilitation services for seniors with complex medical needs.

- Retirement villages often feature resort-style amenities like swimming pools, golf courses, and organized outings for residents.

- Aging-in-place options allow seniors to receive supportive services in their homes while maintaining independence.

- Senior housing communities provide affordable housing options for older adults with limited incomes.

- Active adult communities emphasize an active lifestyle by offering fitness classes, hobby clubs, and volunteer opportunities within the community.

What Retirement Communities Won’t Tell You

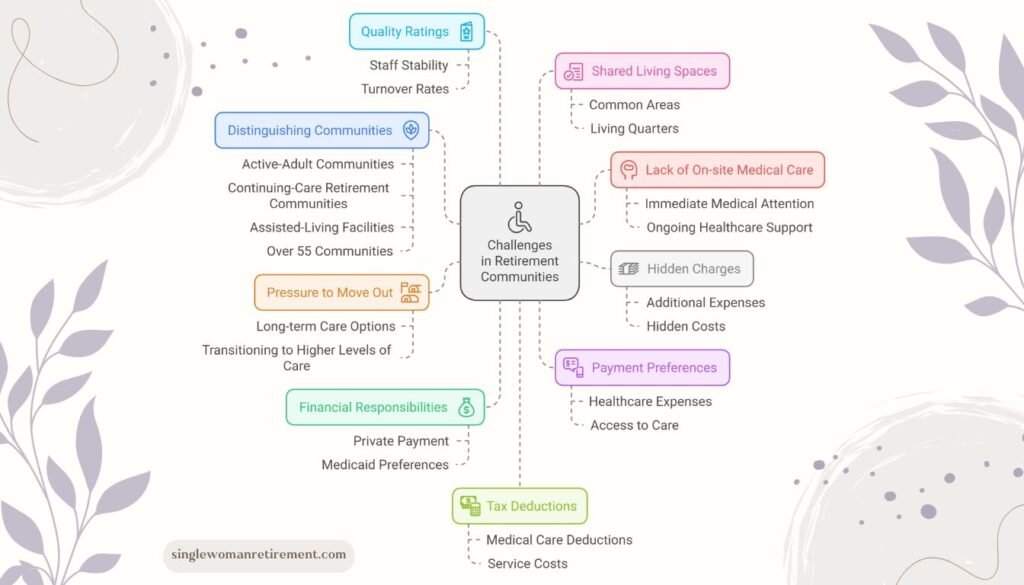

It can be challenging to distinguish between communities

When exploring retirement communities, it’s crucial to understand the differences between various types. Different terms like active-adult communities and continuing-care retirement communities can be confusing.

Glossy brochures may not reveal all the crucial details, so asking questions and visiting in person is essential. Understanding these distinctions helps make an informed decision that aligns with individual needs.

Retirement living options use different terminology, from assisted-living facilities to over 55 communities. Brochures and websites might not show all the downsides or hidden fees.

Lack of on-site medical care

Navigating retirement communities, it’s important to note that the availability of on-site medical care may not always be explicitly disclosed. This can pose challenges for retirees who require immediate medical attention or ongoing healthcare support.

In these instances, individuals must carefully evaluate the proximity of hospitals and medical facilities in the surrounding area to ensure timely access to necessary health services without delay or inconvenience.

Hidden charges

Understanding the financial implications of a retirement community is crucial. Some communities may not fully disclose all potential fees, so asking detailed questions and reading the fine print is essential.

Look out for hidden costs, such as additional expenses for particular services or amenities that may not be included in the standard package. Awareness of these potential extra costs can help you make an informed decision when choosing a retirement community.

Retirement living options might come with unexpected costs, like separate charges for specific activities or facilities within the community. Pay close attention to any potential add-on fees associated with medical care, social activities, or other amenities that could impact your overall budget.

Pressure to move out when care needs increase

As we consider the challenges of retirement communities, it’s essential to understand that residents could be pressured to move out when their care needs increase. Retirement communities might not openly discuss this difficult decision, so it’s crucial to ask about long-term care options and how increasing care needs are managed.

Understanding the policies and support available for transitioning to higher levels of care can significantly impact individuals’ and their families’ decision-making processes.

It is essential for individuals and their loved ones to carefully examine how a retirement community addresses increasing care needs before committing. This includes considering potential moves between different levels of care within the same community or being asked to leave due to healthcare requirements exceeding what the facility can provide.

Potential financial responsibility for parents’ bills

Knowing the potential financial responsibility for parents’ bills is crucial when considering retirement communities. Retirement communities may not disclose all the costs and expenses of their services.

It’s important to carefully review and understand the financial obligations before deciding. Some facilities may prefer private payment over Medicaid, so it’s essential to inquire about payment options and any hidden fees that could impact your finances.

Preference for private payment over Medicaid

When considering retirement communities, it’s crucial to know that some may prefer private payment over Medicaid. This can impact the options available for those who rely on Medicaid for their healthcare expenses.

It’s essential to inquire about payment preferences and understand how they may affect access to care.

Now, let’s explore another hidden aspect of retirement communities – Lack of quality ratings.

Lack of quality ratings

It can be challenging to find reliable quality ratings for retirement communities. The glossy brochures and websites may not provide a complete picture of the quality of care and services.

Staff stability is crucial, but turnover rates among health aides are often high, impacting the overall experience for residents. It’s important to ask detailed questions and do thorough research when considering a retirement community to ensure that the chosen one meets your standards and expectations.

Potential for shared living spaces

Knowing the potential for shared living spaces is essential when considering retirement communities. In some situations, retirees may share common areas or living quarters with other residents.

This can impact privacy and comfort, so it’s crucial to inquire about the extent of shared spaces and how they might affect daily life in the community.

Tax deductions for some fees

When exploring retirement communities, it’s essential to know that tax deductions for specific fees might be available. Some medical care and services costs may qualify for tax deductions, providing financial relief for individuals and families.

Understanding the potential for tax benefits can help make informed decisions about housing options and long-term care arrangements. It’s essential to seek professional advice or research specific eligibility criteria to maximize any available tax benefits.

Making sense of complex financial matters regarding retirement living options is crucial in planning wisely for the future.

How to Prepare and Navigate Retirement Communities

Research and ask questions about the services and fees offered by different retirement communities. Negotiating fees and discussing care options with the community management is crucial.

Also, consider alternatives to traditional retirement communities that suit your needs and preferences better.

Research and ask questions about services and fees

When choosing a retirement community, it’s crucial to dig deep and ask many questions about the services and fees. Some communities may not openly disclose all potential challenges or difficulties that residents may face, so thorough research is necessary.

Look beyond glossy brochures and slick websites to understand what each community offers and how much it will cost you.

Consider alternative retirement communities, like active-adult communities or independent living options. Be sure to negotiate fees and discuss care options directly with the community to ensure transparency in pricing and services.

Negotiate fees and discuss options for care

When considering a retirement community, it’s crucial to research and ask questions about the fees and services offered. Negotiating fees and discussing care options can help make an informed decision that suits financial needs.

It’s essential to be aware of any potential hidden charges or additional costs not initially disclosed by the community.

By negotiating fees and discussing care options, individuals can ensure that they are getting the best value for their money and that their loved ones will receive the necessary care within their budget.

Consider alternatives to traditional retirement communities

Traditional retirement communities may not be the best fit for everyone. Other options to consider include aging in place with support services, co-housing communities, or even staying in your current home and modifying it to meet your changing needs.

These alternatives can provide more personalized care and flexibility, allowing retirees to maintain their independence while still getting the required assistance.

Furthermore, exploring shared living arrangements with peers or family members could offer a strong sense of community and help alleviate feelings of isolation often experienced by older adults.

Conclusion: 10 Things Retirement Communities Won’t Tell You

In conclusion, retirement communities may not reveal all the essential details. It’s crucial to ask questions and research thoroughly. The strategies provided are practical and efficient for navigating retirement communities.

Implementing these approaches can lead to significant improvements in choosing the right community. Explore additional resources for further insight into senior living options.

Additional resources for choosing the right retirement community.

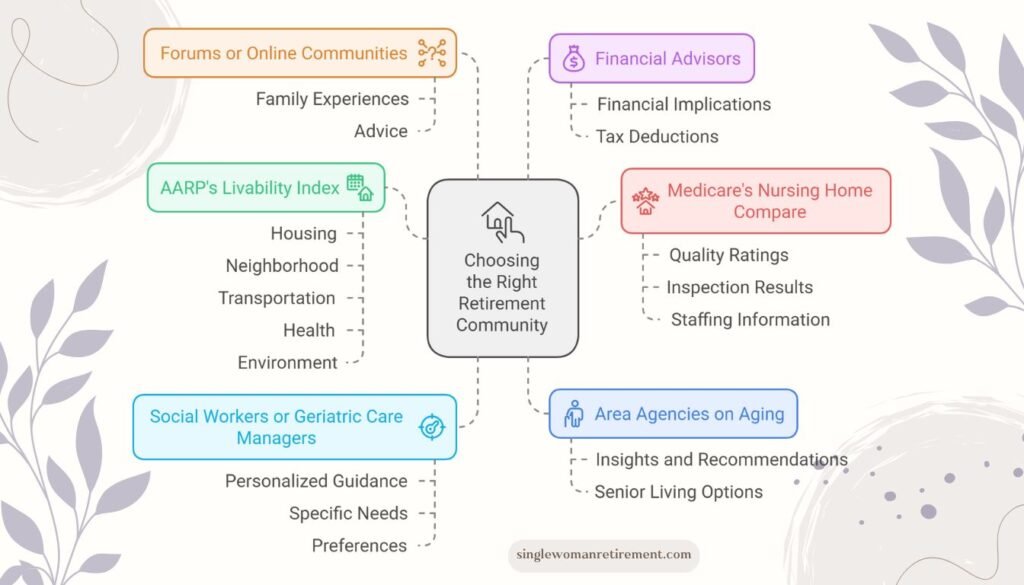

Here are some resources to help you choose the right retirement community:

- Contact local Area Agencies on Aging for information about various senior living options, including retirement communities and assisted living facilities. They can provide valuable insights and recommendations.

- Utilize online tools such as AARP’s “Livability Index” to compare communities based on housing, neighborhood, transportation, health, and environment.

- Consider joining forums or online communities where family members of retirees share their experiences and offer advice on choosing the right retirement community.

- Visit Medicare’s Nursing Home Compare website to access quality ratings, inspection results, and staffing information for your area’s nursing homes and assisted living facilities.

- Engage with financial advisors specializing in retirement planning to understand the financial implications of moving into a retirement community and explore potential tax deductions for specific fees.

- Connect with social workers or geriatric care managers who can provide personalized guidance and support in evaluating various retirement community options based on your specific needs and preferences.

Read More about Retirement Plans

- 7 Reasons You Should Rent a Home in Retirement for Financial Sense

- 10 Emotional Signs You Need to Retire: How to Know When It’s Time

- The Best Retirement Signs: Custom, Printable, and Homemade Options

- Utilizing a Retirement Analyzer Tool to Maximize Your Retirement

- 101 Things to Do When You Retire: An Irreverent and Fun Guide to Life After Work

FAQs

1. What are some secrets about retirement communities?

Retirement communities might not tell you some downsides, like hidden costs or the fact that they may not suit everyone’s lifestyle.

2. Are there myths about living in senior care facilities?

Yes, there are myths! Some people think these places are only for seniors, but many offer different levels of care and activities for various needs.

3. What drawbacks should I know about before moving into an assisted living home?

It’s essential to ask about extra fees and to check if the community fits how you want to live during your retirement years.

4. Can independent living communities have drawbacks too?

Yes, even independent living can have issues like unexpected cost increases or rules that limit your freedom more than you’d like.